People choose to freelance either for financial freedom or for a more flexible working arrangement. But they find themselves having to tackle everything from marketing their services to sending payment invoices to their clients.

Of course, everybody wants to get payments on time and without any hassle. Yet if you’ve barely started freelancing, you may find it challenging to send invoices to your clients. Also, some common questions like “when and how should I send the invoices” arise while you start preparing your invoices.

So, here are some fantastic tips to create a professional invoice, helping you manage as a freelancer. There’s also a complete guide to invoicing that you can read to better understand invoicing as a whole.

The Basics

The format of the invoice depends largely on the freelancing gig or invoicing system you use.

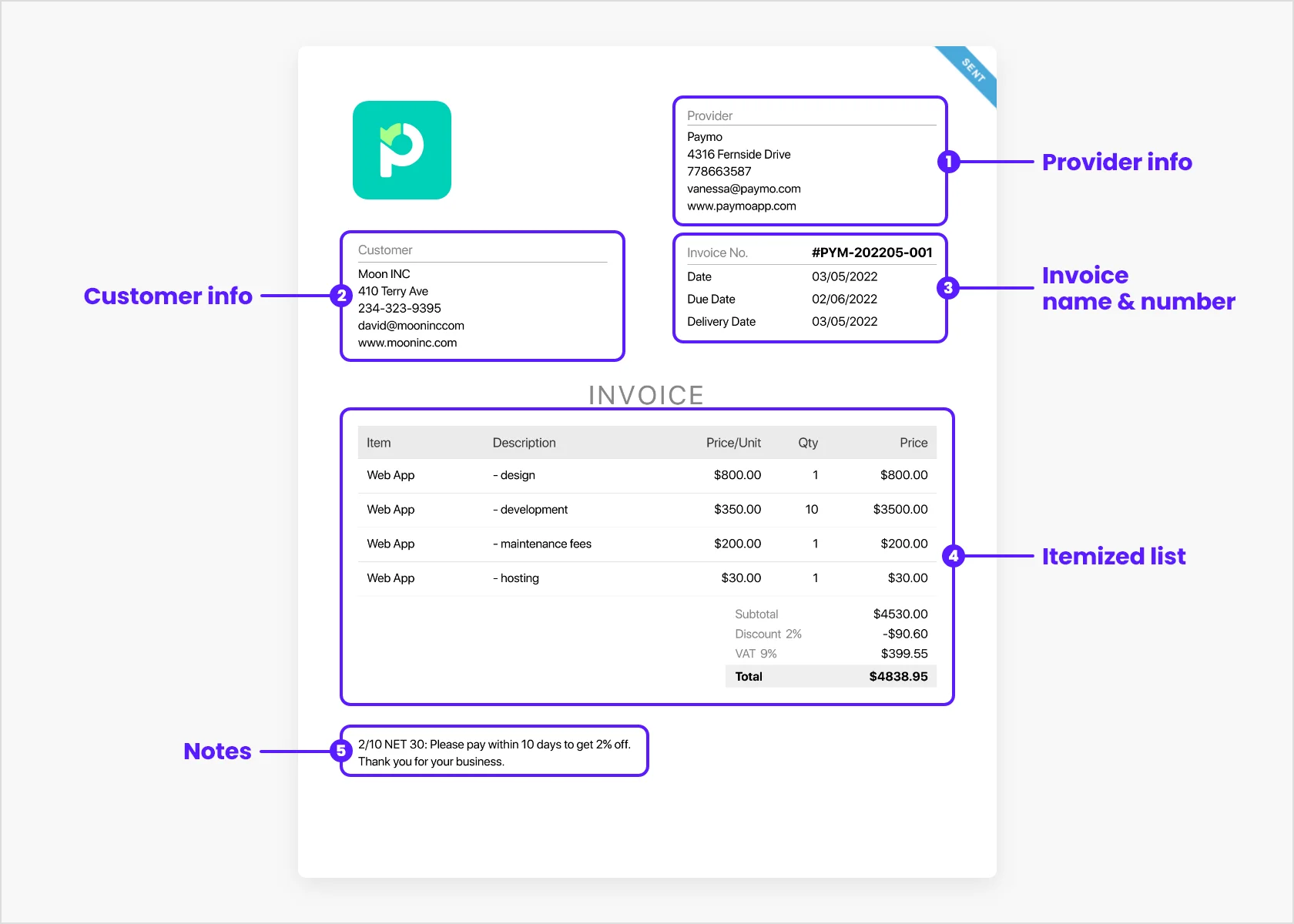

However, here are some key components that you must include in any invoicing format. You can create compelling and simple invoices by following the steps below.

The Header

Make sure you add a professional header at the top of your invoice since it is the first thing that catches your client’s attention. Even if you don’t possess designer skills, you can create your own logo design with the help of a logo maker. To emphasize the header, make it bold. Sure, the contact details may vary depending on the type of business, but adding an email address and website is a must.

If you are a freelancer who works with international clients, it is not necessary to add your phone number. Instead, you can add your Skype username for a quick talk. And make sure while you write your contact details, you write each contact on individual lines, rather than everything on a single line.

Example

- [email protected]

- abc.com

- 202-555-0164

Client’s Contact Details

After adding your contact details, you need to add your client’s. You need to add them on separate lines rather than in a single line. Adding the contact details of your clients is a sure way to know you are sending the invoice to the right client.

Example

- Name: XYZ

- Email: [email protected]

- Address: 123 East 17th Street

- St. Louis 130201

Invoice Numbers

Now, you need to add an invoice number. It should be a numerical value that allows you to track your invoices. There is no thumb rule, really. But when you’re generating invoices, you should use a sequence to avoid any confusion later. For example, if the number of your first invoice is #001, then the following invoice numbers should be #002, #003, and so on.

Delivery Date and Due Date

The delivery date should be the date when you send the invoice to your client. It helps you track the payment history of your clients easily.

And the due date is the date by which your client must pay you. Generally, a due date is by the end of the month or at the end of a project. If you’re using invoicing tools, your client receives payment reminders, so you won’t have to track the due dates yourself.

List of Your Services

You want your clients to know that they are getting their money’s worth. So, break down your services to avoid any back and forth questioning during payment. List all your services in detail on separate lines. For example, if you are a content writer, jot down the types of content, titles, word count, and the amount to be paid for each piece.

Include Your Payment Terms

When a freelancer sends an invoice, the goal is to get paid as early as possible without delay. You can add your payment terms to make the process simple and fast. The payment terms may include late fines, cancellation charges, etc.

Total Payable Amount

At last, after adding the details of your services, their cost, and payment terms, you need to add the total amount due. The final amount you will get is the total due amount, so make sure you avoid any mistakes. Also, your client will understand which works and how much they are paying. Making the total amount bold is the best practice to catch the client’s eyes first.

Adding Various Payment Methods

As a freelancer, you can have multiple payment options. The easiest way is to connect to a payment gateway so that your clients pay you directly from the invoice you send them. Before opting for any payment options, make sure they offer good rates. If you’re dealing with international clients, you should take into consideration their currency exchange rates.

Besides payment gateways, you can add your bank details to the invoices. Whatever method you choose for payment, include them in your invoice, and double-check the information to avoid any mistakes.

Different Ways to Invoice as a Freelancer

Invoicing is a key factor after delivering your project or content to your client. Most freelancers find invoice creation complex and get confused about the essential elements that need to be placed while creating their invoices.

You can opt for any of these three different invoicing methods to create your invoice and send your client. The three invoicing methods are contracting an accountant, creating invoices manually—not by hand, though!—and generating invoices automatically.

Appointing an Accountant

If you are starting afresh, you can go for the other two methods of invoice creation, e.g., manual invoicing or automatic invoicing. But if it becomes a mental burden for busy freelancers to manage their taxes, then opt for professional accounting services.

Some freelancers prefer to only focus on their work and see bookkeeping as tedious. If that’s you, find a professional accountant.

Manual Invoicing

If you have some prior experience in invoice creation, then it is an extra benefit for you as a freelancer. You can create your customized invoice using different templates in Google Sheets & Docs or MS Word & Excel.

There are plenty of templates you can buy online for cheap. Still, you’d have to put in the effort to edit and proofread them, send them manually and make sure they’re not lost, and keep track of the due dates and paid amounts.

Automatic Invoicing Software

In today’s world, to ease up and simplify the invoice creation process, there is a wide range of invoicing solutions, such as invoice generators and invoicing software.

Paymo offers a robust invoice module that helps you manage your estimates, expenses, and invoices, set up online payment gateways, send recurring invoices, and organize them neatly.

Mistakes to Avoid when Sending Invoices

There are various mistakes that a freelancer needs to avoid. Some of the crucial ones are listed below.

1. Sending Unprofessional Invoices

The biggest mistake freelancers make is not being professional. So before sending the invoice, make sure you create a professional-looking invoice. You can use various websites or software to create your invoice by choosing templates. So before sending the invoice, make sure you go through the invoice properly. If you’re freelancing while in college and using a student bank account, this step is fundamental as you will come off as professional and experienced.

2. Sending Invoices Late

Another common mistake many freelancers make is sending invoices late. Sending late invoices to clients reflects unprofessionalism and reluctance about work. So, send your invoices on time. You can set reminders two days prior on your phone so that you won’t forget about it.

3. Not including the Due Date

Freelancers face the issue of getting late payments from their clients. You can add a due date to your invoice to avoid such practice from your client’s end. Including the due date will make things easy for you to mention in your invoice that if clients miss clearing the invoice amount on or before the due date, they will have to pay late fees.

4. Sending Invoice to Wrong Client

This is one of the most common mistakes freelancers make – sending invoices to the wrong email, person, or wrong client. This later creates a lot of confusion and takes much longer than usual to clear the invoice amount. So pay attention before you send your invoice to any client.

5. Unclear Pricing

When creating an invoice, make sure you specify the price of the products or services that you have offered. Another mistake many freelancers make is assuming clients know their pricing and rates by heart. Also, mention taxes and discounts if there are any in the invoice so that the client has a clear picture of the project’s costs.

Conclusion

If you’ve barely started, it could seem that invoice creation is a complex process. But there is a wide range of solutions—from Microsoft templates to robust invoicing tools like Paymo—to help you in all financial aspects.

Plus, contracting an accountant will be the best suitable option for you as software and websites will not be able to calculate your liabilities properly. Suppose you are running your business and hiring freelancers or employees to work hourly. In that case, you can go for the software time doctor as they provide robust and seamless solutions to track productivity and payment.

First published on June 23, 2022.

Ravi Soni

Author

When he's not sipping tea with his wife or listening to audiobooks, Ravi is a Search Engine Marketer who manages end-to-end funnel SEO and is responsible for acquiring leads through organic marketing and building partnerships with other SaaS brands.