You’ve landed a fantastic new project, but before diving in, there’s one essential task to handle—documentation. You need to organize everything upfront: outline the costs, timeline, and deliverables, all neatly laid out to prepare you for the real work.

That’s where proforma invoices come in—they act as a blueprint, laying out exactly what’s expected and what’s owed in return. They’re a powerful tool for preventing those pesky “I thought that was included” misunderstandings and keeping scope creep firmly in check.

In this article, we’ll walk you through the process of crafting a proforma invoice that protects both you and your clients.

We’ve got templates, tips, and best practices to help you keep things crystal clear and aboveboard—so you won’t find yourself chasing payments or explanations later on.

What is a proforma invoice?

A proforma invoice is a kind of “pre-invoice” that’s sent before the real deal. It’s a detailed list showing what a client will pay for, how much it’ll cost, and when they’ll pay it. Think of it as a promise in writing, but not quite as official as a full invoice.

A proforma invoice doesn’t demand payment; it’s just a heads-up of what to expect. It doesn’t carry the same legal weight as a regular invoice. It’s more of an estimate or a preview. You can’t use it to force payment like a full invoice can.

Who does it help, and how?

A proforma invoice helps both you and your client.

It lays out everything clearly for you, ensuring there’s no confusion about what’s being offered or how much it’ll cost.

For the client, it gives them a look at the costs before they agree to anything. It helps avoid misunderstandings, saves time, and keeps everything smooth sailing.

What a proforma includes

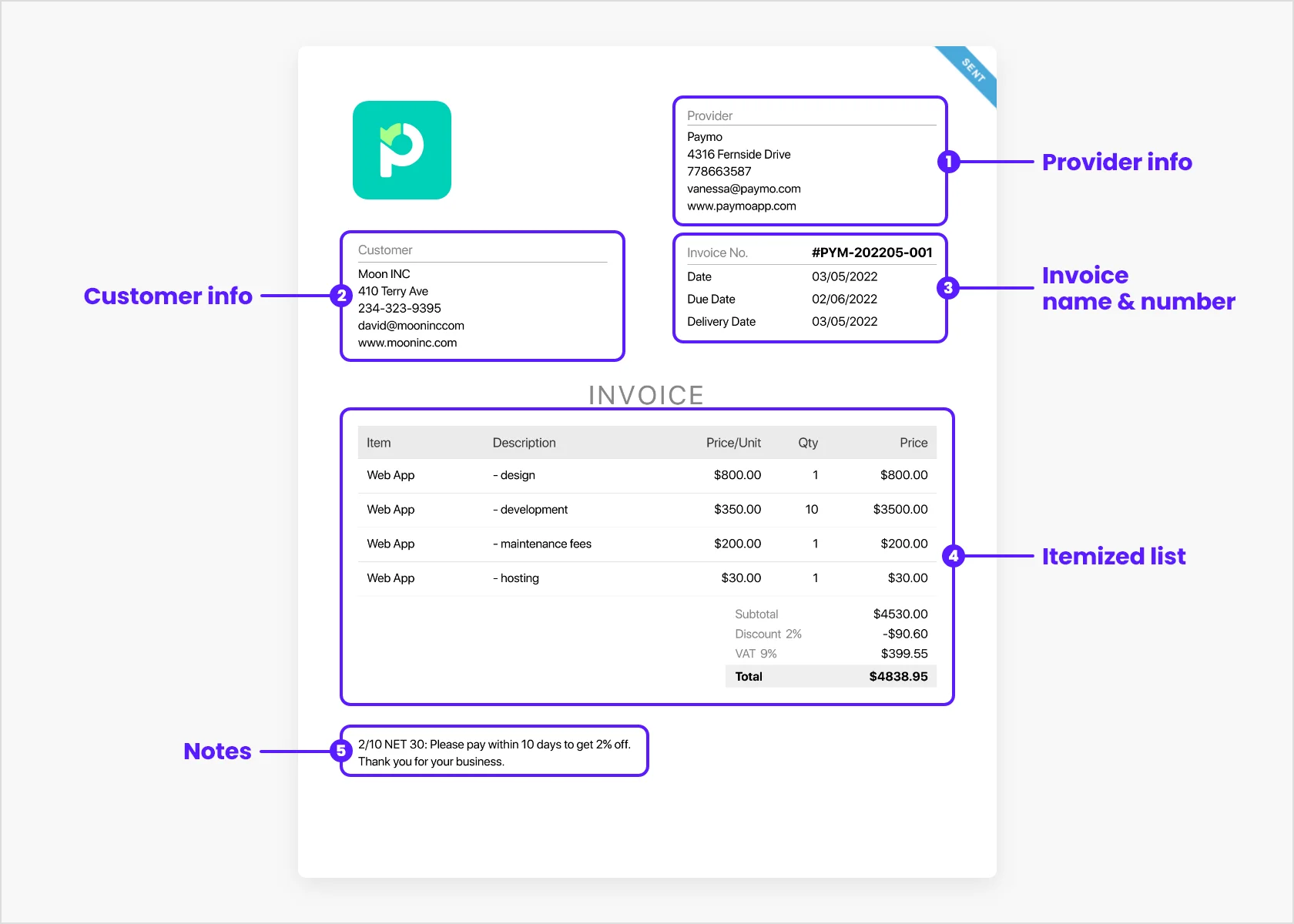

A proforma invoice usually includes:

- Buyer and Seller Details: Contact information and tax IDs (especially for international trade).

- Description of Goods/Services: Item names, quantities, unit prices, and total cost.

- Shipping and Additional Costs: Breakdown of shipping charges, taxes, and duties.

- Payment Terms: When and how payment should be made, along with price validity.

- Delivery Details: Expected delivery dates or deadlines and any trade-specific details.

What is the purpose of a proforma invoice?

Proforma invoices serve multiple purposes:

- Pre-sale Documentation and Cost Estimation: This document shows the buyer exactly what they’re getting and the full cost—shipping, taxes, and all. It helps them decide before they commit.

- Customs Clearance Facilitation: It gives customs the necessary details, speeding up the process and avoiding delays.

- Advance Payments: Sellers can request part or all of the payment before shipping, lowering their financial risk.

The proforma invoice helps your client review the costs and decide whether to move forward with the purchase, but it doesn’t require them to make a payment yet.

If they approve, you can proceed with the order, and once the parts are ready to ship, you’ll send an official invoice for payment.

How is the proforma invoice different than other invoices?

A proforma invoice is sent before delivery, outlining the costs the buyer can expect to pay. It’s essentially a preview, helping the buyer understand what they’re committing to.

Unlike a regular invoice, which is issued after delivery and requests payment, a proforma invoice doesn’t require payment upfront.

You can learn more about invoicing in this beginner-friendly detailed invoicing guide.

Benefits of proforma invoices for businesses

Proforma invoices offer multiple benefits that can streamline processes and enhance client relationships.

- Improve Cash Flow: They help secure partial or advance payments, boosting liquidity for ongoing projects.

- Minimize Disputes: By clarifying costs upfront, they reduce the likelihood of payment disputes and discrepancies later.

- Improve Communication: Provides a detailed transaction overview, fostering buyer and seller transparency.

- Make Business Run Better: A clear price preview helps everything flow smoothly, from customs clearance to planning big orders.

When should you send a proforma invoice?

A proforma invoice is typically sent at the early stages of a sales process, particularly before the actual goods or services are delivered. It’s common in B2B transactions, international sales, and service-based businesses when there’s a need to clarify order details or agree on pricing.

Every business deals with proforma invoices differently. Here’s when you should send one:

- For Business Customers: Send it early when your customer first asks about prices. They often need this document to get approval from their bosses or purchasing department. It helps them plan their budget and understand exactly what they’re buying.

- For International Sales: Your customer needs this document to clear customs and arrange import permits. Send it before shipping so they can handle the paperwork on their end. This prevents delays at the border and surprise fees.

- For Service Work: If you’re a consultant, freelancer, or service provider, send it when discussing project details. It helps set clear expectations about what you’ll deliver and what it will cost.

“We work with international freelance writers, and cultural differences shape work expectations. That’s why we use proforma invoices to outline deliverables—deadlines, revisions, and payment terms. This clarity upfront avoids confusion.”— Dominic Monn, founder of MentorCruise.com

Legal considerations of proforma invoices

While a proforma invoice is not legally binding, it establishes an informal agreement between buyer and seller. In some cases, it can serve as more than just a preliminary document.

Michele Patrick, CFO at Hennessey Digital, states,

“In situations like trade finance applications, letters of credit, or proving export intent, a proforma invoice can act as an official document. In these cases, it’s essential for meeting obligations between buyers, sellers, and financial institutions.”

Building on this understanding of proforma invoices’ dual nature – both informal and potentially official – there are several key legal points that you must keep in mind:

- Seller’s responsibilities: Be honest about your prices and what you’re selling. Wrong information can cause problems with customers and customs. List everything accurately, from product details to delivery times.

- Buyer’s responsibilities: Acknowledging a proforma invoice implies understanding the terms, though it doesn’t confirm a binding contract.

- International transactions: Make sure you list all the details customs will need. Include clear product descriptions and where they come from. Show prices before and after any taxes. This helps your shipment move through customs faster.

- When taxes apply: Different places have different tax rules. Some sales need VAT or local taxes added. For international sales, taxes might wait until the final sale. Always write down which taxes apply and who pays them.

- Exemptions and common concerns: In some cases, such as international exports, taxes may be deferred until final sale, but it’s recommended to clarify tax implications to avoid surprises.

A step-by-step Guide to creating a proforma invoice

Creating professional proforma invoices doesn’t have to be complicated—it’s all about having the right foundation and tools.

Here’s how to get started:

1. Pick the right tool for the job

The choice of software matters more than you’d think. Nowadays, more than a simple Google Sheets is needed to get the job done—companies of all sizes benefit from invoicing software like Paymo, which makes tracking, storing, and reusing templates easier.

The right tool keeps invoicing simple and saves time by filling in the blanks for you—no need to repeat yourself each time.

2. Add your company details

At the top, you’ve got to include your essentials: company name, logo, address, and contact information. When working internationally, adding tax IDs or registration numbers is wise. This isn’t just a formality.

A polished and complete proforma tells clients they’re dealing with a professional operation. These small details keep things clear and avoid awkward misunderstandings down the line.

3. Include client and invoice information

Each invoice needs a unique number, today’s date, and complete client details—billing address, contact person, etc. If you’re dealing with international clients, jot down their tax ID and any specific requirements for their country.

Having these details ready saves you from hunting through emails later, and it makes sure everyone’s got the right information to hand if they need to check back on the invoice.

4. Add a clear breakdown of services

Each service listed with its description and price gives clients a straight answer on what they’re paying for.

Instead of lumping things under “Marketing Package – $2,000,” a line-by-line breakdown—like “Social Media Strategy – $500, Content Calendar – $700, Ad Campaign Setup – $800”—does the job better.

These details clear up any questions and set the client’s expectations right from the start, sparing you from questions later.

5. Use clear terms and totals

Payment terms, accepted methods, and the validity period of the quote are important here. A good proforma doesn’t just lay out the subtotal, taxes, and fees; it shows the total where nobody can miss it.

Upfront terms help keep payments on schedule and everyone on the same page. A bit of clarity now means a lot fewer questions—and faster payments—later on.

Common challenges while using proforma invoices

While proforma invoices are an essential tool in business transactions, there are some common challenges you might face as a business owner when using them. Here’s how to avoid or resolve these issues:

1. Not understanding what proforma invoice means

A frequent misunderstanding is that a proforma invoice is a formal payment request. Remember, a proforma invoice is only an estimate—it’s a quotation or draft version of the final invoice. To avoid confusion:

- Clearly label it as a “Proforma Invoice” to indicate it’s not a demand for payment.

- Communicate the purpose of the proforma invoice to your buyer—clarify that it’s for quotation purposes only.

2. Delays in obtaining a commercial invoice

After issuing a proforma invoice, some sellers may delay in providing the commercial invoice, which can slow down the transaction.

To prevent this:

- Once the buyer agrees to the proforma invoice, quickly prepare the commercial invoice to avoid unnecessary delays in delivery or payment.

3. Discrepancies between proforma and commercial invoices

Discrepancies can arise if the final commercial invoice differs from the proforma invoice. This can cause issues during customs clearance or disputes over the final amount. To avoid this:

- Ensure the proforma invoice is accurate and up to date before issuing it.

- Make sure the commercial invoice closely matches the proforma invoice to prevent discrepancies.

4. Incomplete proforma invoices

For international transactions, incomplete or inaccurate proforma invoices can result in delays at customs. Customs officers need accurate descriptions, prices, and compliance information (HS codes, country of origin). To avoid delays:

- Double-check all details on the proforma invoice.

- Ensure that all necessary information for customs is included.

By being proactive and thorough, you can avoid these common pitfalls and streamline your transaction process.

Best Practices for creating proforma invoices

A proforma invoice needs to be clear and accurate, even if it’s not your final bill or a commercial invoice. Here are some best practices to ensure you create effective proforma invoices that benefit both you and your customer.

1. Ensure accuracy

Accuracy counts in every part of your invoice. Start with clear descriptions that tell customers exactly what they’re paying for. If you’re selling a “Custom Website Package,” spell out what’s included – like how many pages, revisions, and features they’ll get.

Before you send it, double-check the following details:

- Product Descriptions: Ensure that each item or service is correctly described so the buyer knows exactly what they’re getting.

- Quantities and Unit Prices: Be clear about the number of items or units being sold and the cost per unit.

- Shipping Costs: Accurately estimate shipping fees to avoid later discrepancies.

2. Use a consistent format and layout

Your invoice’s look matters as much as its content. A clean, organized layout helps customers quickly find what they need and shows you mean business.

Put your logo on the top left and business details top right. Then, group information in four clear sections:

- Invoice Details – Number and valid date

- Customer Details – Name, contact, and address

- Service Table – Items, descriptions, and costs

- Payment Info – Total amount and bank details

It’s also a good idea to leave white space between sections. This simple layout makes it easy for customers to find what they need.

Pro Tip: Save this format as your template. When every invoice looks the same, customers know exactly where to look for the information they need.

3. Indicate that it’s a “Proforma Invoice”

At the top of the document, prominently display the title “Proforma Invoice.” This ensures the buyer and any other party (like customs officers) understand this is not a final invoice but a preliminary estimate. This distinction is important to prevent any confusion with a commercial invoice.

4. Specify the validity period

Markets change fast. Material costs go up. Shipping gets more expensive. By setting a clear end date for your proforma, you protect your business from these changes. It also helps customers make faster decisions when they see the deadline.

Most businesses give customers 30 days to accept their quote. You might opt for a shorter time span if you sell things with changing prices, like electronics. Or give more time for stable services like consulting.

5. Provide clear payment terms

Tell customers exactly when and how they need to pay. Some businesses ask for advance payments or deposits—if you do, write down the exact amount you need.

Specify two key things in your payment section: First, when you expect payment – whether it’s before or after you deliver. Second, list how customers can pay you, like bank transfers or credit cards.

Add any extra costs for late payments. If you charge penalties or fees when someone pays late, write these down clearly.

Example: “Payment Terms:

- Due date: [before/after] delivery

- We accept: Bank transfer, credit card

- Late payments incur [X%] fee”

6. Include relevant trade compliance information

If the goods are being shipped internationally, it’s important to include compliance information such as:

- HS/tariff codes: These are special numbers that tell customs what you’re shipping and what taxes apply. Think of them as product passports—your goods might get stuck at the border without them.

- Country of origin: Write down where each item comes from. The country of origin helps customs figure out the right fees and taxes.

Remember: Missing these details can delay your shipment and cost extra money.

Proforma invoices in different industries with examples

Proforma invoices are versatile documents used across various industries and types of transactions. While their core purpose remains the same, the specifics can vary depending on the industry.

1. International trade and export/import transactions

In global trade, customs authorities often require proforma invoices to assess the value of goods before they’re shipped. This helps buyers and sellers navigate tariffs, taxes, and import/export duties efficiently. It also ensures the shipment moves smoothly across borders.

Example: A company exporting electronics from the U.S. to Europe will issue a proforma invoice detailing the product specs, quantity, and shipping terms for customs clearance purposes.

Proforma Invoice Template

Seller Information

- Company Name:

- Address:

- Contact Person:

- Email:

- Phone:

Buyer Information

- Company Name:

- Address:

- Contact Person:

- Email:

- Phone:

Invoice Details

- Invoice Number:

- Invoice Date:

- Valid Until:

- Currency:

- Payment Terms: (e.g., 50% upfront, 50% before shipping)

| Item Description | Quantity | Unit Price (USD) | Total (USD) |

| [Product Name, e.g., Laptop Model X] | 10 | $500 | $5,000 |

| [Product Name, e.g., Keyboard Model Y] | 20 | $50 | $1,000 |

Subtotal: $6,000

Shipping Charges: $200

Total Amount (USD): $6,200

Shipping Terms

- Incoterms: (e.g., FOB, CIF, etc.)

- Estimated Delivery Date:

- Shipping Mode: (e.g., Air, Sea)

- Port of Origin: (e.g., New York)

- Port of Destination: (e.g., Rotterdam)

Compliance and Customs Information

- HS Code: (e.g., 8471 for computers)

- Country of Origin: United States

- Special Instructions: (e.g., Handle with care, Fragile)

2. B2B Sales and Procurement

In business-to-business (B2B) sales, proforma invoices provide a quotation for goods or services before the final purchase agreement. They help businesses estimate costs and secure internal approvals.

Example: A company selling industrial machinery may issue a proforma invoice to a buyer, allowing them to review the cost breakdown and arrange financing before making a purchase.

Proforma Invoice Template

Seller Information

- Company Name: Industrial Solutions Inc.

- Address: 123 Industrial Park, City, State, Zip

- Contact Person: John Doe

- Email: [email protected]

- Phone: (555) 123-4567

Buyer Information

- Company Name: Machinery Corp

- Address: 789 Manufacturing Blvd, City, State, Zip

- Contact Person: Jane Smith

- Email: [email protected]

- Phone: (555) 987-6543

Invoice Details

- Invoice Number: PRO-001

- Invoice Date: [Today’s Date]

- Valid Until: [30 Days from Today’s Date]

- Currency: USD

- Payment Terms: 50% Deposit, Balance Due Before Shipment

| Item Description | Quantity | Unit Price (USD) | Total (USD) |

| Industrial CNC Machine Model Z | 2 | $20,000 | $40,000 |

| Assembly Line Conveyor Model A | 1 | $15,000 | $15,000 |

Subtotal: $55,000

Shipping Charges: $1,500

Total Amount (USD): $56,500

Shipping Terms

- Incoterms: FOB

- Estimated Delivery Date: [45 Days from Today’s Date]

- Shipping Mode: Sea

- Port of Origin: Los Angeles

- Port of Destination: Yokohama

Compliance and Customs Information

- HS Code: 847989 (Industrial Machinery)

- Country of Origin: United States

Note: This proforma invoice provides an estimate and is not a final invoice. Price is subject to confirmation at the time of order.

3. Construction and project-based industries

In project-based industries, such as construction, proforma invoices help businesses estimate costs for materials, labor, and other expenses before a project begins. This is crucial for budgeting and securing project funding.

Example: A construction company may issue a proforma invoice to a client for a new building project, detailing the materials and labor costs involved.

Proforma Invoice Template

Seller Information

- Company Name: BuildCo Supplies

- Address: 456 Construction Road, City, State, Zip

- Contact Person: Sarah Johnson

- Email: [email protected]

- Phone: (555) 234-5678

Client Information

- Company Name: Modern Constructions Ltd.

- Address: 321 Project Lane, City, State, Zip

- Contact Person: Alex Brown

- Email: [email protected]

- Phone: (555) 876-5432

Invoice Details

- Invoice Number: PRO-002

- Invoice Date: [Today’s Date]

- Valid Until: [30 Days from Today’s Date]

- Currency: USD

- Payment Terms: 30% Advance, 70% on Completion

| Description | Quantity | Unit Price (USD) | Total (USD) |

| Concrete (Type B) | 100 Cubic Yards | $200 | $20,000 |

| Structural Steel Beams | 50 Pieces | $300 | $15,000 |

| Labor (Initial Phase) | 200 Hours | $50 | $10,000 |

Subtotal: $45,000

Site Delivery Charges: $500

Total Amount (USD): $45,500

Project Timeline

- Estimated Project Start: [30 Days from Today’s Date]

- Estimated Completion Date: [120 Days from Start Date]

Compliance and Regulatory Information

- Applicable Building Codes: [Specify Code Details]

- Country of Origin for Materials: United States

Note: This proforma invoice is a preliminary budget estimate for materials and labor. Final amounts will vary based on project requirements.

4. Healthcare and medical equipment sales

In healthcare, proforma invoices are commonly used when selling medical equipment or supplies. Hospitals and healthcare providers often require cost estimates before committing to large purchases, especially for expensive machinery.

Example: A medical supplier issues a proforma invoice to a hospital for a new MRI machine, allowing the hospital to budget for the purchase.

Proforma Invoice Template

Proforma Invoice

Date: October 30, 2024

Invoice Number: PI-1045

From:

MediSupply Solutions Inc.

123 HealthTech Park

Boston, MA 02118, USA

Phone: +1 (617) 555-0134

Email: [email protected]

To:

Saint Mary’s Hospital

987 Wellness Blvd

Austin, TX 73301, USA

Phone: +1 (512) 555-0198

Description of Goods and Services:

| Item | Quantity | Unit Price (USD) | Total Price (USD) |

| MRI Machine Model 7T-Pro | 1 | $350,000.00 | $350,000.00 |

| Installation and Setup | 1 | $5,000.00 | $5,000.00 |

| User Training Session | 2 days | $750.00 | $1,500.00 |

| Warranty Coverage (3 years) | 1 | $10,000.00 | $10,000.00 |

| Total | $366,500.00 |

Terms and Conditions:

- Payment Terms: 30% advance payment, 70% upon delivery and installation

- Validity: This proforma invoice is valid for 60 days

- Delivery Date: Estimated within 90 days of confirmed order

- Shipping Terms: FOB Boston, MA

- Insurance: Covered by MediSupply Solutions Inc. during transit

- Warranty: 3-year warranty included

- Cancellation Policy: 10% restocking fee for cancellations after order confirmation

This proforma invoice provides the cost breakdown for budgeting purposes only and is not a payment request. An official invoice will follow upon order confirmation.

Start creating proforma invoices now!

Now that you’ve seen how proforma invoices can make or break a deal—from locking in trade finance to clearing exports—it’s clear that getting them right matters.

They might start as informal but often hold real weight in business communication. Pay attention to the details, especially in international trade, and you’ll avoid costly delays.

Ready to simplify your invoicing? Check out our invoice templates to create precise, professional documents with ease.

Jason Hennessey

Author

Jason Hennessey is an entrepreneur, author, business coach, and internationally recognized speaker with over two decades of experience in digital marketing and business growth. As CEO of Hennessey Digital since 2015, he has led the company’s expansion into a $10MM+ enterprise with a team of 100+ experts, earning recognition on the Inc. 5000 list twice. A U.S. Air Force veteran, Jason is passionate about empowering others through education, mentorship, and innovative strategies for success.

Alexandra Martin

Editor

Drawing from a background in cognitive linguistics and armed with 10+ years of content writing experience, Alexandra Martin combines her expertise with a newfound interest in productivity and project management. In her spare time, she dabbles in all things creative.