In today’s business world, being efficient is a must. The modern world requires modern solutions and recurring invoices are one of those solutions.

Others might include a professional web design for superior performance. Hop here if you want to grow your brand online.

This article will tell you everything you need to know about recurring invoices and help you decide whether they are what your business needs.

Let’s start by answering some basic questions:

- What is a recurring invoice?

- What are the types of recurring invoices?

- What are the benefits of recurring invoices?

- Are recurring invoices suitable for your business?

- How do you get paid faster online?

What is a recurring invoice?

A recurring invoice is a payment model that allows business owners to bill their clients for products or services at predetermined intervals—weekly, bi-weekly, monthly, annually—or customized intervals.

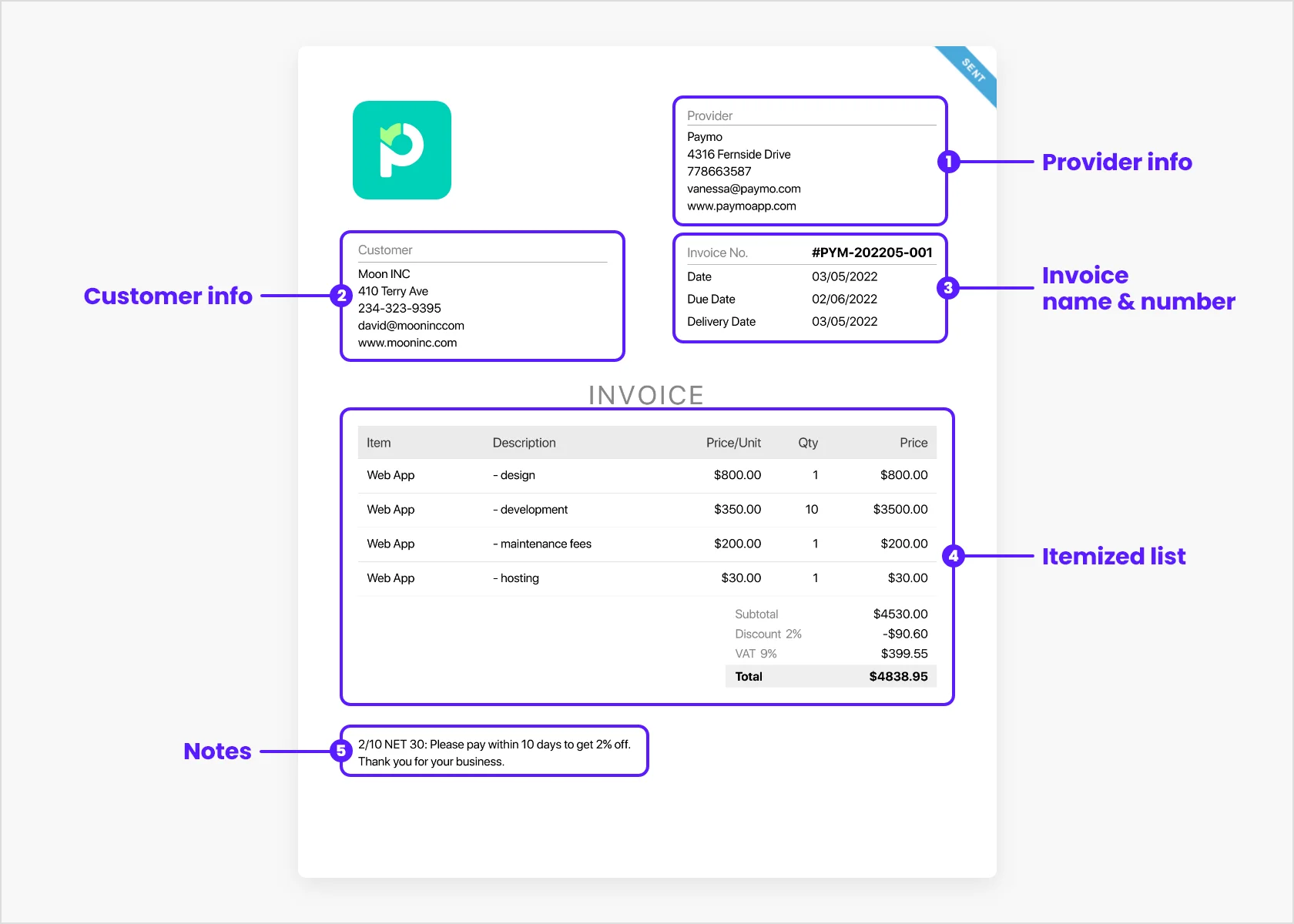

It contains the same details as a normal invoice, such as:

- Invoice number

- Your company’s name and address

- Client’s name and address

- Summarized description

- Date of supply

- Payment terms, etc.

This payment model is usually handled by automated invoicing software.

Read this complete invoicing guide to learn all about invoices, along with advice to follow and pitfalls to avoid.

What are the types of recurring invoices?

We can differentiate two types of recurring invoices – fixed and variable.

Fixed recurring invoice is used when you need to bill your clients for the same amount in every payment cycle.

Variable recurring invoice is used when you need to bill your clients for different amounts in every payment cycle. For example, if you base your bills on the clients’ usage of the services, like the number of internet gigabytes spent.

What are the benefits of recurring invoices?

Using recurring invoices as your payment model can have many benefits. We have selected the top four:

- Improved cashflow. Recurring invoices can help you set a steady stream of income. This will allow you to make more precise projections about your cash flow and better plan your business operations.

- Improved client relations. Implementing recurring invoices into your workflow will help you gain more trust from your clients. With this payment model, you will never be late with your invoices. As a result, your clients will perceive you as their extended team rather than an ad-hoc vendor.

- Faster clients’ payments. When you set a recurring invoice to be sent to your clients on the same day each month, they will be accustomed to the steady payment faster. It will become a routine task, and routines are harder to break.

- Saved time. A recurring invoice payment system can automate the entire billing process. You won’t have to worry about keeping track of the subscriptions, payment information, sending notifications, etc.

You would be relieved from a great deal of manual work. This will save you time and reduce your administration costs.

How do you get paid faster online?

If you’re based in the US, an online payment gateway is a convenient method for your clients to pay you quickly and securely via credit card and ACH. We recommend PM Payments, an invoicing solution from Paymo. After you send your client an invoice—recurring or not—PM Payments enables your clients to securely pay you online directly from that same invoice. After the payment is made, the invoice is automatically updated, and you receive a notification of that transaction.

Plus, since it’s in Paymo, you get detailed reporting, robust analytics, and payment history from all your invoices processed by PM Payments to assist you in your bookkeeping—and you can export all that data.

Are recurring invoices suitable for your business?

Certain businesses can benefit greatly from a recurring invoice payment system, while others might find it challenging to implement it in their workflow.

Here is where recurring invoices can contribute greatly to the overall business workflow:

- Service-based companies that bill for a fixed number of working hours per month

- Companies that provide monthly service packages

- Companies that offer maintenance plans for various products, such as software installation, optimal system uptime sustaining, or something simpler, like gardening services

- Businesses that offer access to an online educational and training material

- Membership or subscription-based businesses, such as gym membership or a streaming services subscription (Netflix, Amazon Prime)

- Software providers – charge a monthly or annual fee for product usage

If you can relate to the following business types, you should consider using this payment model for your business.

Now that we covered the basics, let’s answer the burning question.

How to create a regular invoice

How you create your recurring invoice depends mainly on the software of your choice. There are many project management applications, but here we will focus on how to create your recurring invoice in Paymo.

We’ll show you how to create a regular invoice first.

You start by opening the accounting drop menu. To add an invoice, click on the invoices module.

The green “Add Invoice” button will appear, and by clicking it, you’ll open the invoice editor.

Here, you can choose the currency for billing your client, whether or not you accept online payments, and the format of the invoice template. Select the client for billing services.

Now you will need to convert timesheet entries into invoices. Select the date interval, the projects to parse time entries from, and the users.

After you add time entries, you will get the subtotal of all the time entries to which you can add taxes, like VAT or state tax:

You can also leave an invoice note for your client. After you click “Save,” you can send an invoice directly to a client or share it via the permalink in the top right corner.

When your client opens the invoice, the color of the ribbon in the top right corner will change.

You can change invoice status anytime and mark it as draft, void, or paid. You can print it, export it as a PDF file, or share it with third-party accounting software.

This is what your client sees after you send it:

How to create a recurring invoice

This is how you would create a regular invoice. To create a recurring invoice, go to the recurring menu tab in Accounting. Click on the green “Add Recurring” button in the top left corner.

Set up the “New Recurring Profile”. Select the start date, frequency, and the number of occurrences.

Your client will automatically receive invoices at the time intervals you have set. When you finish making your recurring invoice, it should look something like this:

Conclusion

Recurring invoices can save you time and money and make your business run more smoothly. This model is a great way to simplify your processes, improve cash flow, and strengthen client relationships.

We hope our article helped you understand if recurring invoices are an excellent choice for your business and how to create them in one of the best project management applications. If you want professional help, team up with one of the top payroll companies to help you manage accounting.

Aleksa Radovic

Author

Young but passionate, Aleksa is enthusiastic about all things SEO. He will take every opportunity to practice, study, read—and write—about it.