Scammers create fake invoices to trick companies into making payments for products and services they haven’t received. These receipts often mimic authentic bills that may use real supplier names and company logos.

Fraudsters look for and exploit vulnerabilities within financial departments in your organization to push their schemes further effectively.

When unnoticed, fake invoices can lead to significant financial losses on top of monetary mismanagement, strained vendor relationships, and legal complications. The extent of these consequences is particularly severe for small and growing businesses.

In this article, let’s look at five tips to help you spot fake invoices to protect your company’s financial interests and steer clear of fraudsters.

1. Examine formatting and quality

Counterfeit payment requests appear subtle, hinting at their illegitimacy. These inconsistencies occur because scammers typically lack access to proprietary invoicing software that legitimate businesses and enterprises use.

A few common giveaways include:

- Inconsistent design and formatting: Irregular spacing, misaligned text, or mismatched fonts are a few design and formatting faults in fake invoices. Genuine receipts are typically created with standardized templates, making them uniform and professional.

- Low-quality logos and branding. Authentic bills carry high-resolution logos, maintain accurate color schemes, and have certified branding elements. Scammers typically download these details from the web, creating a blurry or pixelated appearance.

- Missing or incorrect invoice number. The invoices from your actual vendors have a unique reference number that follows a particular format and sequence. Fraudulent payment requests may lack them or feature one that doesn’t follow the usual patterns.

- Spelling and grammar errors: Authentic invoices are created by professionals who conduct spelling and grammar checks before sending them over. Scammers usually don’t focus on clarity and formality, opening the door for typos and grammatical errors.

Fraudulent receipts are often created manually rather than through proprietary invoicing software. This makes them particularly susceptible to design, formatting, and semantic issues that can be quickly spotted.

2. Verify your and vendor details

If the receipt looks okay at first glance, you must examine it further to ensure its authenticity. The following elements to examine include the recipient (your) and vendor details.

Side note: When verifying vendor details, it is equally important to scrutinize the details of payroll companies handling salary disbursements. Payroll fraud can occur when scammers manipulate payee details, introduce fake employees, or alter payment instructions. Cross-checking vendor information and using reputable payroll providers minimizes these risks.

A few things to look out for:

- Mismatch in vendor information: Name, address, or contact details may be manipulated slightly to imitate real suppliers. Small spelling changes in names or the email domain are clear markers that you are dealing with an impostor.

- Incorrect details of the payee (you): Identical to vendor information, your details may be incorrectly mentioned on the bill. Fraudsters lack the resources and sincerity to conduct in-depth research on your organization, resulting in these blatant errors.

- Changes in payment instructions: Businesses make payments to their vendors and partners through predefined methods. However, scammers often provide new account numbers, claiming they have switched banks. It is crucial to verify these changes first.

- Different person of contact: Companies receiving payment requests usually communicate with dedicated personnel, such as an account manager. Fake invoices feature a different professional, typically the scammers themselves.

Teams should keep in mind that even genuine invoices and bills may have the aforementioned errors for various reasons. If the payment request seems plausible but has mistakes in the vendor and recipient details, it is better to contact your stakeholders and verify.

3. Cross-check invoice particulars

The next crucial element of business invoices is the products or services you are charged for. Vendors and suppliers clearly highlight the details of your purchases in the receipt, ensuring transparent communication and streamlining bookkeeping.

Fraudsters either miss key details of these particulars or cannot elaborate on them further upon closer inquiry. Here’s how to examine the particulars:

- Compare with purchase orders and contracts: Cross-check your internal purchase orders for products and service requirements with the details in the invoice. Watch out for goods you never received and services you haven’t requested.

- Contact and ask for additional explanation: For example, if you receive an invoice for the maintenance of IoT security systems, even though you never signed a maintenance contract, call the vendor (through official contact details) to verify the scam attempt.

- Look for duplicate invoices: Scammers send an identical receipt with different payment details. Companies may make the payment because the particulars match. Use automated accounting software to help flag repeated payments.

- Unexpected charges or fees: Fraudulent invoices often carry hidden expenses, such as processing costs and late payment penalties. If your vendor typically doesn’t do this, contact them immediately to ensure you have the right receipt.

Basically, if you are charged for something you don’t remember purchasing or receiving, contact the vendor for further explanation. You can also contact the scammer through the details present in the fake bill to check their legitimacy or lack thereof.

4. Be alert to urgent requests

As you may have realized by now, fake invoices can be easily spotted through proper verification. A closer look at various elements of the receipt will reveal inconsistencies, errors, and red flags that reveal the scammer’s attempts.

Consequently, swindlers create a sense of urgency to encourage you to skip the verification process and transfer the funds immediately. Hence, you must keep an eye out for:

- Pressure to pay immediately: Scammers may claim that failing to clear the invoice instantly could result in cancellation of the order or legal repercussions. Legitimate vendors and suppliers, on the other hand, often provide comfortable payment windows.

- Unusual payment methods: Gift cards, cryptocurrency, and wire transfers to unfamiliar accounts are red flags. The con artists will explain that the vendor has shifted from their usual ways due to recent internal requirements.

- Impatience in answering queries: Genuine partners and stakeholders will take the time to clarify your doubts related to the invoice. On the other hand, the hustlers will make it look like it’s your fault and push you to make the payment.

- Requests for advance transfers: Prepayment to confirm or “lock in” your order for goods or services may indicate an underlying scam, especially if it deviates from past agreed-upon payment procedures.

Keep in mind that business invoices often request large monetary amounts. Always take appropriate time to ensure the request is legitimate. If required, communicate with your vendors, suppliers, and internal accounting teams to verify the validity of the bill.

5. Implement strong internal controls

The best defense you can develop against invoice fraud is by establishing a clear internal receipt review protocol. The process should help your team examine each element of the payment request bill.

After each of those elements is validated and verified, you can then transfer the funds.

The key steps around it include:

- Establishing a verification process: It is better to create multiple levels of verification to approve a particular invoice. For efficiency, you can modify the degree of thoroughness based on receipt familiarity and transaction amount.

- Using invoice matching systems: Manually checking multiple payment requests can slow operations. You will be overloaded with administrative tasks. To curb this, you can leverage AI-powered detectors to cross-check invoice details with

- Training employees to recognize scams: Anyone in your team can make a mistake, as humans may do from time to time. Hence, organizations should invest in employee education to appropriately deal with fraudulent invoices.

- Conduct regular audits. Audits help reveal vulnerabilities within your organization related to processes, tools, and personnel. You can then use the insights to iterate your invoice approval process to ensure your company’s financial safety.

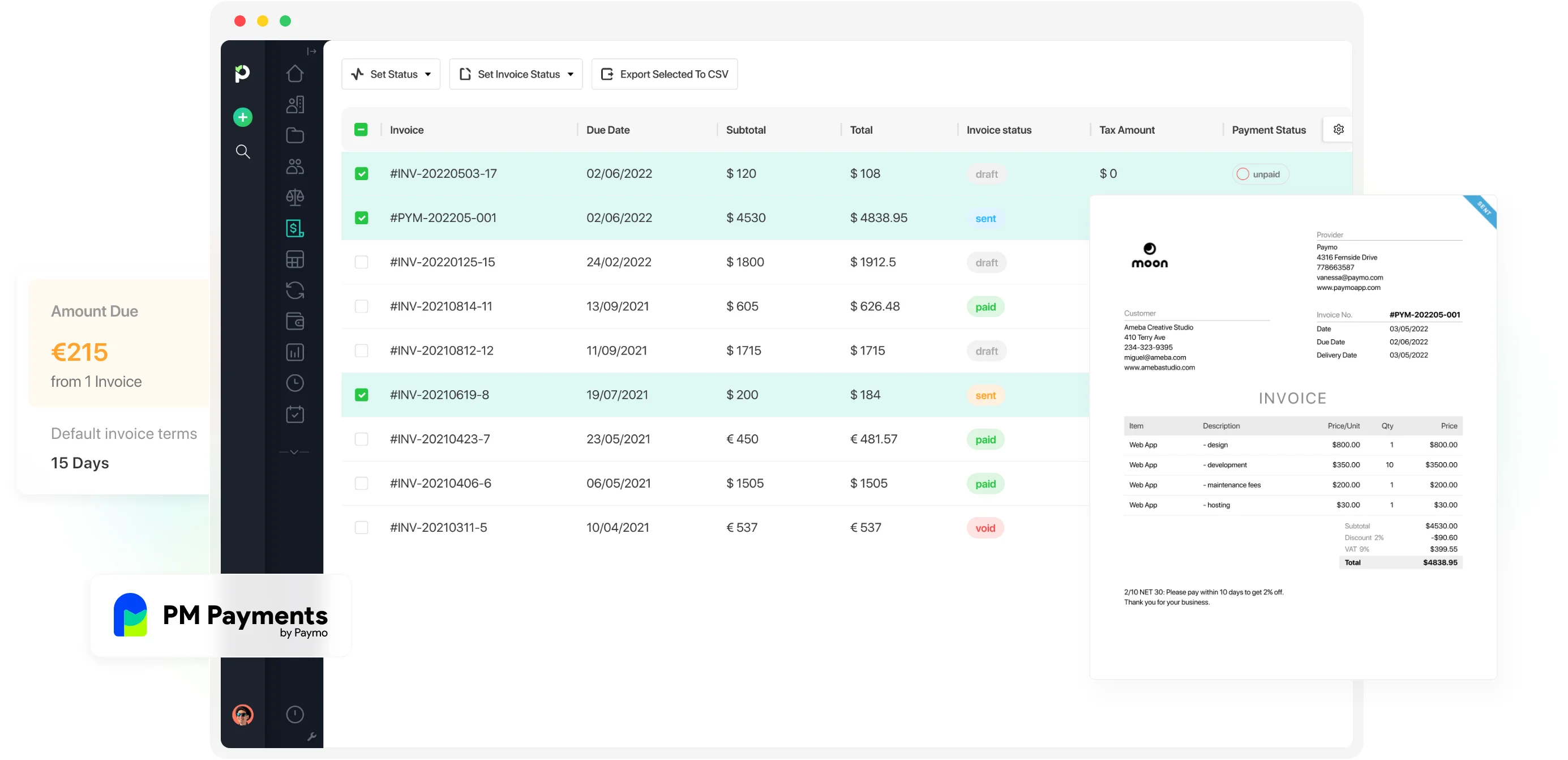

Implementing robust invoicing software is a critical defense against fake invoices and payment fraud. Modern invoicing platforms offer automated validation features that can instantly flag suspicious elements like duplicate invoices, unusual payment amounts, or sudden changes in vendor details.

Wrapping Up

Tackling scammers is a continuous process. As technology evolves, so does their approach toward creating fraudulent payment requests and receipts. This leads to improved monetary management and better vendor relationships.

Invoice fraud can cause significant financial losses and disrupt business operations. Detecting fake payment receipts early is crucial to preventing unauthorized payments and protecting the company’s financial resources. Businesses should examine formatting and quality to spot fraudulent invoices, looking for inconsistencies in design, low-quality logos, and spelling errors.

Verifying vendor and sender details helps catch discrepancies in company names, payment instructions, and contacts. Cross-checking invoice particulars against purchase orders and contracts ensures legitimacy, while reviewing for duplicate invoices and unexpected charges prevents overpayment. Being alert to urgent requests helps businesses recognize pressure tactics, suspicious payment methods, and unauthorized advance payment requests. Lastly, implementing strong internal controls—such as verification processes, invoice matching, employee training, and regular audits—strengthens fraud prevention.

Carl Torrence

Author

Carl Torrence is a Content Marketer at Marketing Digest. His core expertise lies in developing data-driven content for brands, SaaS businesses, and agencies. In his free time, he enjoys binge-watching time-travel movies and listening to Linkin Park and Coldplay albums.

Alexandra Martin

Editor

Drawing from a background in cognitive linguistics and armed with 10+ years of content writing experience, Alexandra Martin combines her expertise with a newfound interest in productivity and project management. In her spare time, she dabbles in all things creative.