🌼 Spring Special Offer - Save up to 40% on your first 3 months with Paymo!

Check plans and prices

Create free unlimited invoices and get paid online

Focus more on your business profitability and less on managing paperwork.

How to turn invoicing from a frustrating chore into an effortless experience

Create invoices, manage estimates & expenses, and automate payments. Drive profits higher with you behind the wheel.

Create invoices

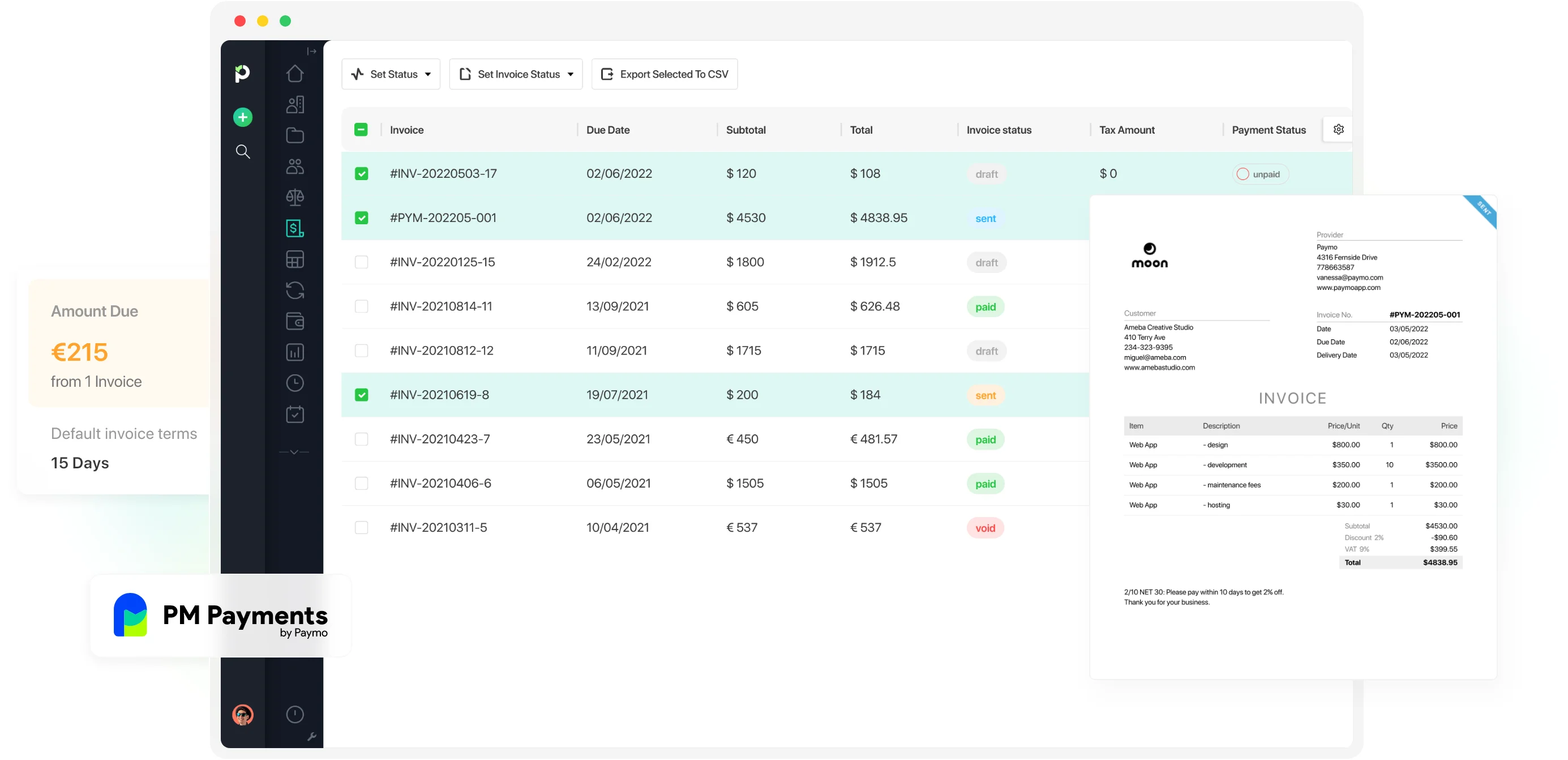

Generate invoices

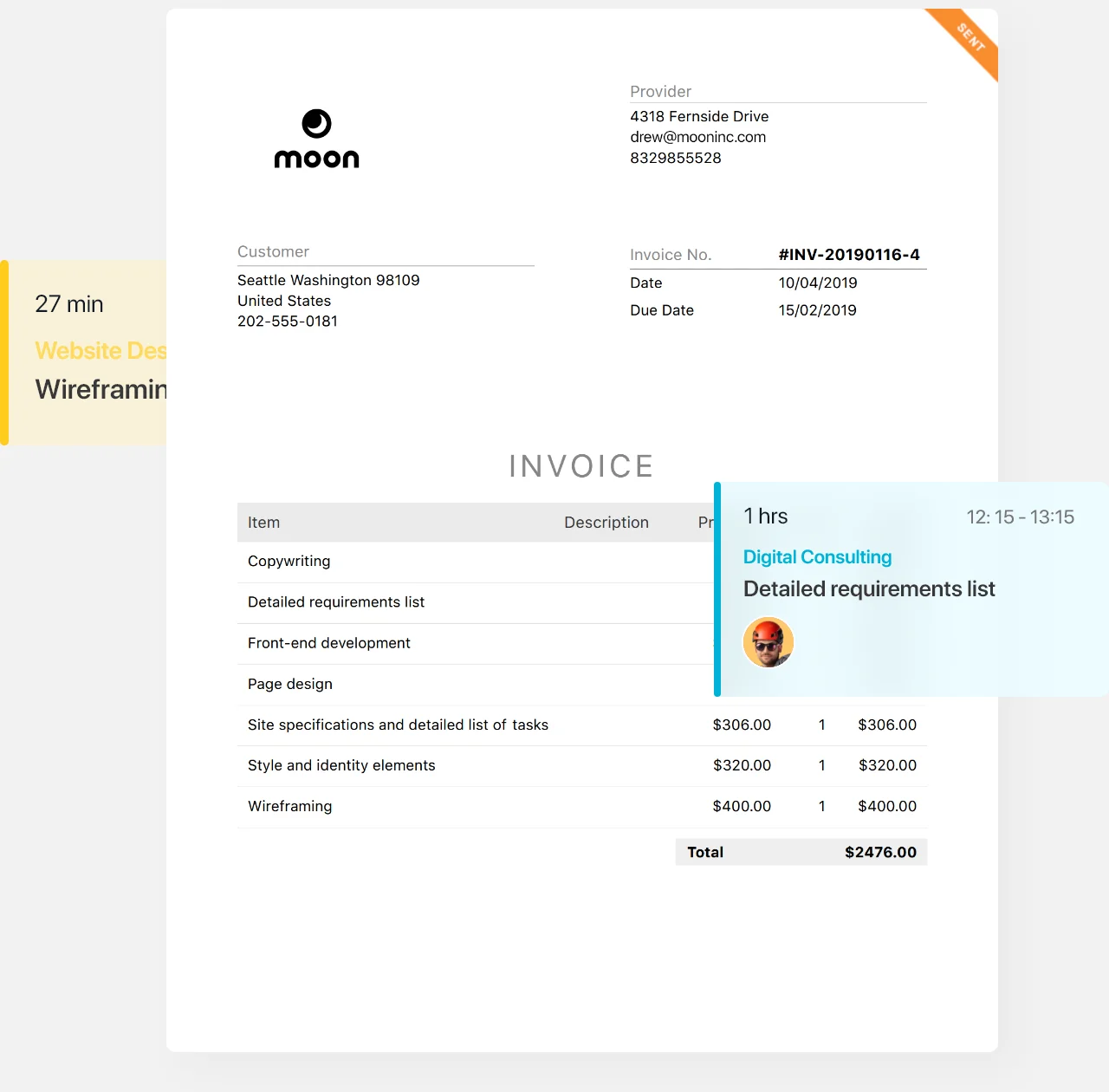

Turn timesheet data into an invoice and make adjustments manually in just a few clicks. Or simply clone it to save time, so you don’t have to start from scratch every time you bill clients. All invoice editing is done in WYSIWYG mode.

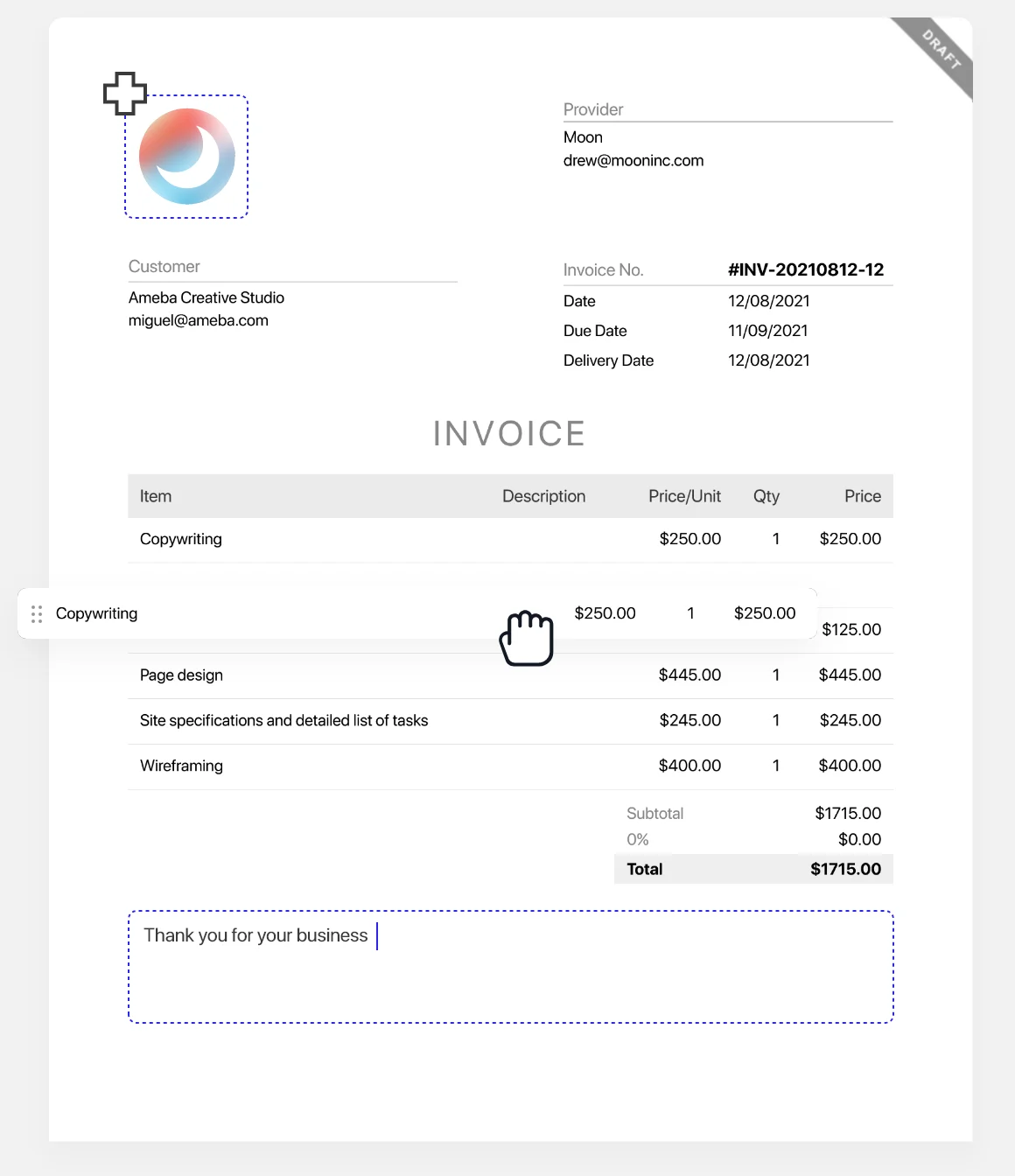

Customize invoices to your liking

Be memorable. Customize your invoices to reflect your brand better. Add your company logo, edit existing templates with HTML/CSS, or add a personalized thank-you note for your client to stand out from the competition and leave a lasting impression.

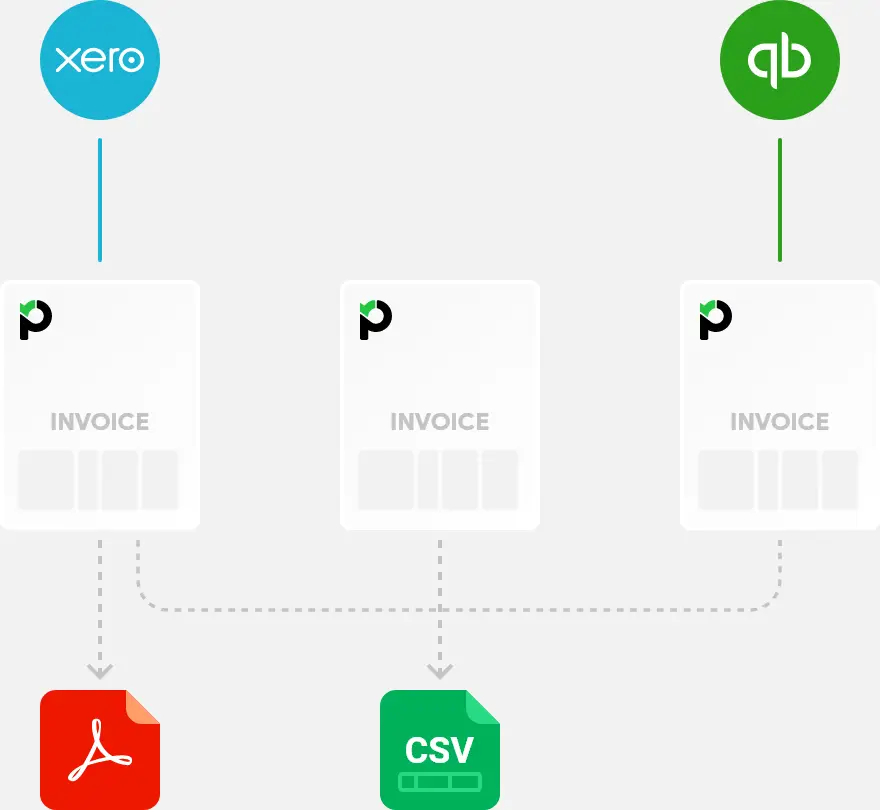

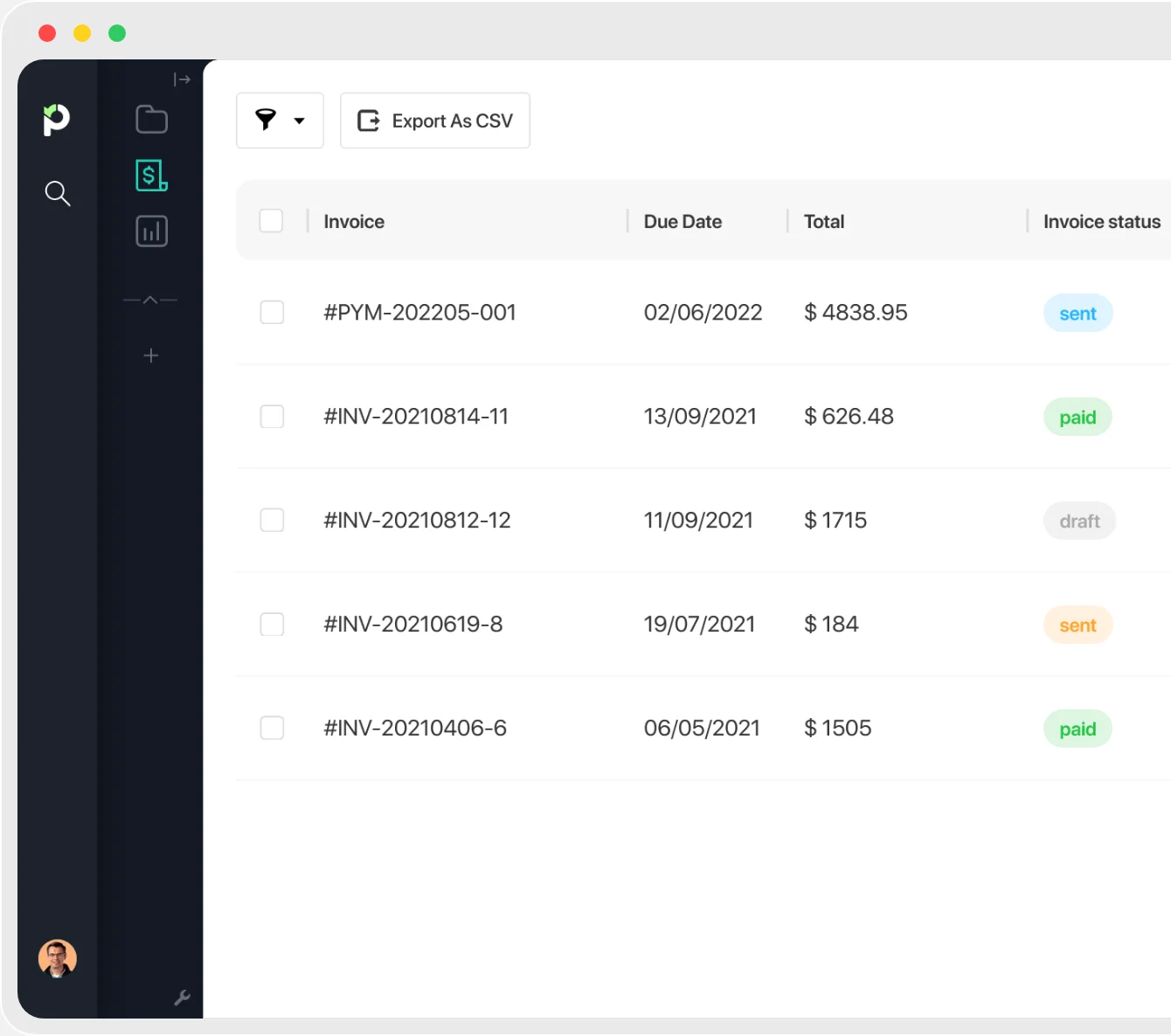

Export invoices

Keep an accurate record of your invoices. Export them one by one as PDF or in bulk in a CSV. You can also sync them with the accounting tool of your choice—QuickBooks or Xero—to keep your books in order. You'll definitely make your accountant happy!

Manage estimates & expenses

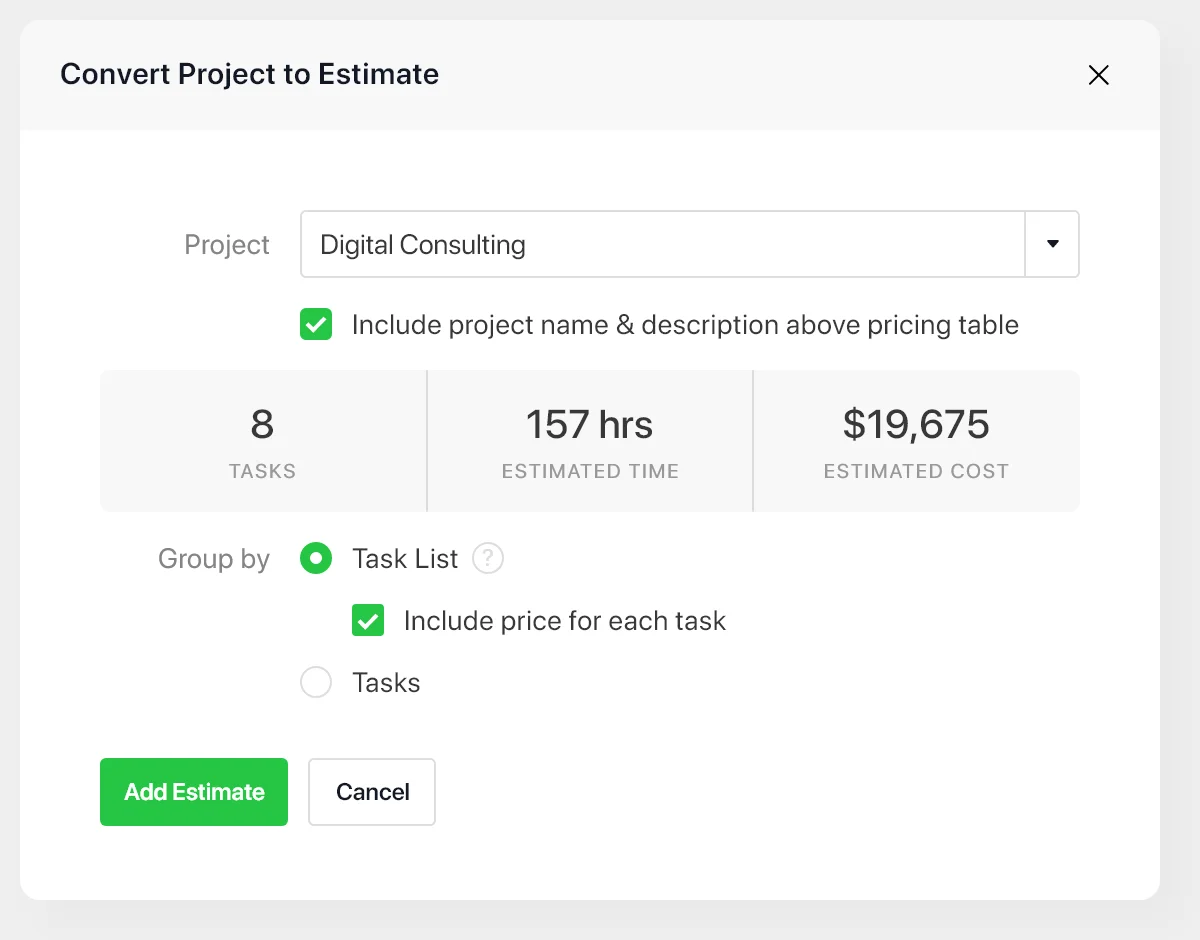

Create estimates

Design professional estimates can be time-consuming. Plan your project first, then convert it into an estimate with pre-filled tasks, hourly budgets, and costs. Once your client accepts it, turn it into an invoice to streamline delivery.

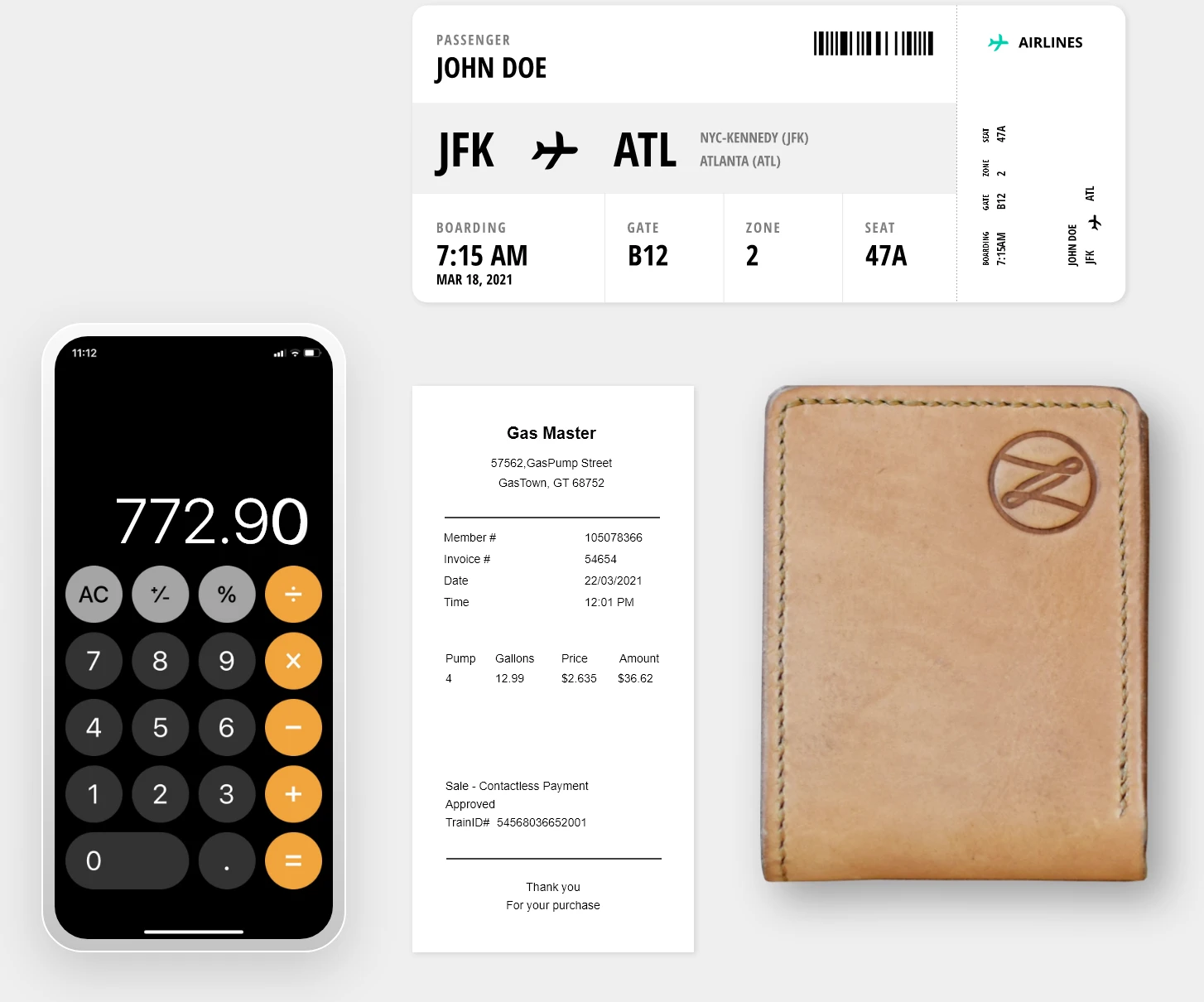

Add and track expenses

Prepare for the tax season well in advance. Record every expense at a client or project level, so you can forget about storing receipts once and for all. The tag manager also helps you organize them under categories to know your team’s top spender.

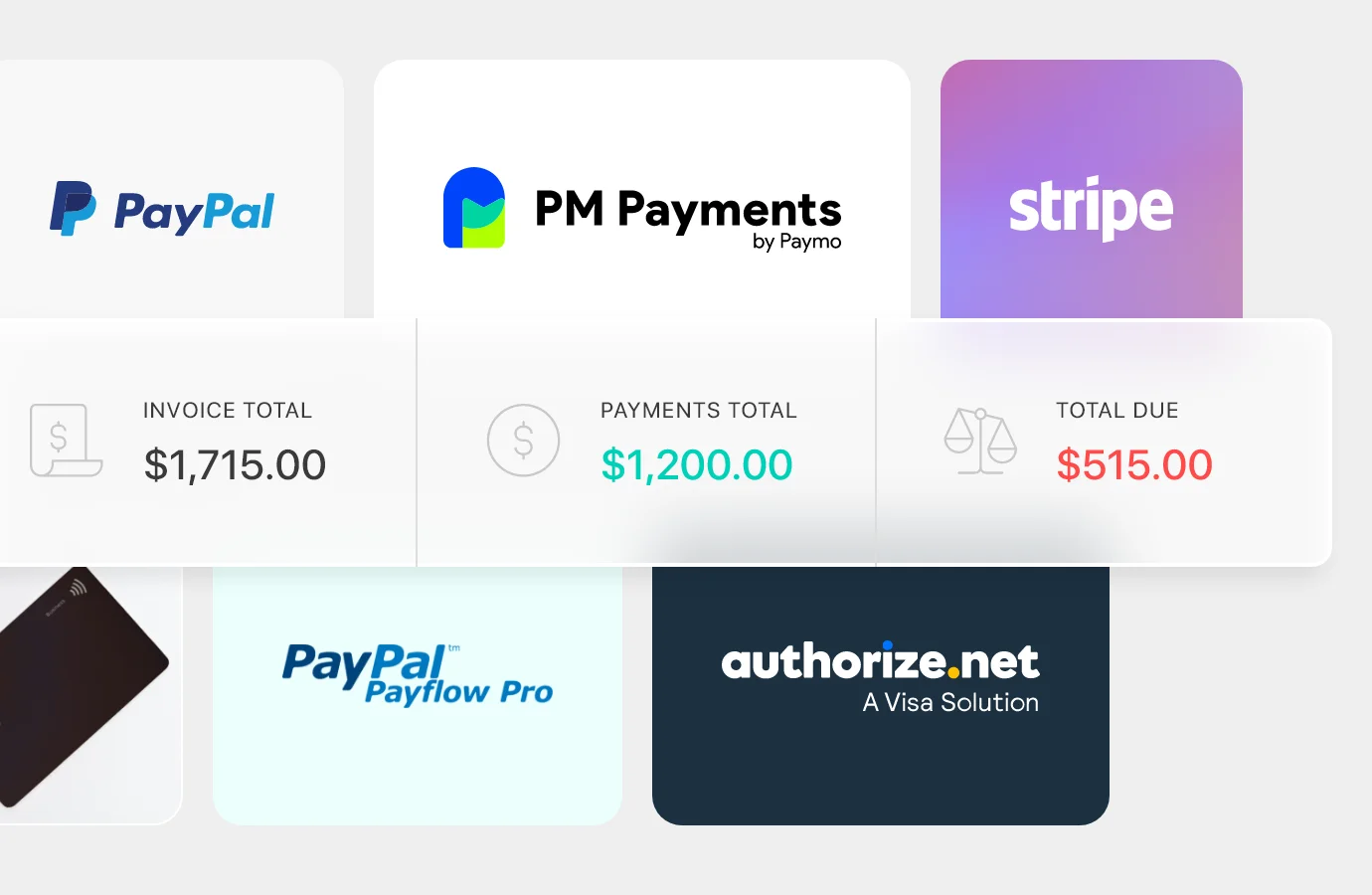

Get paid faster

Whether PM Payments or others, you can set up payment gateways and make it easy for your clients to pay you securely, directly from an invoice. If they want to pay you in cash or by wire transfer, add a down payment and view the due amount in the same place. Once paid, the invoice is automatically marked as “paid.”

Automate payments

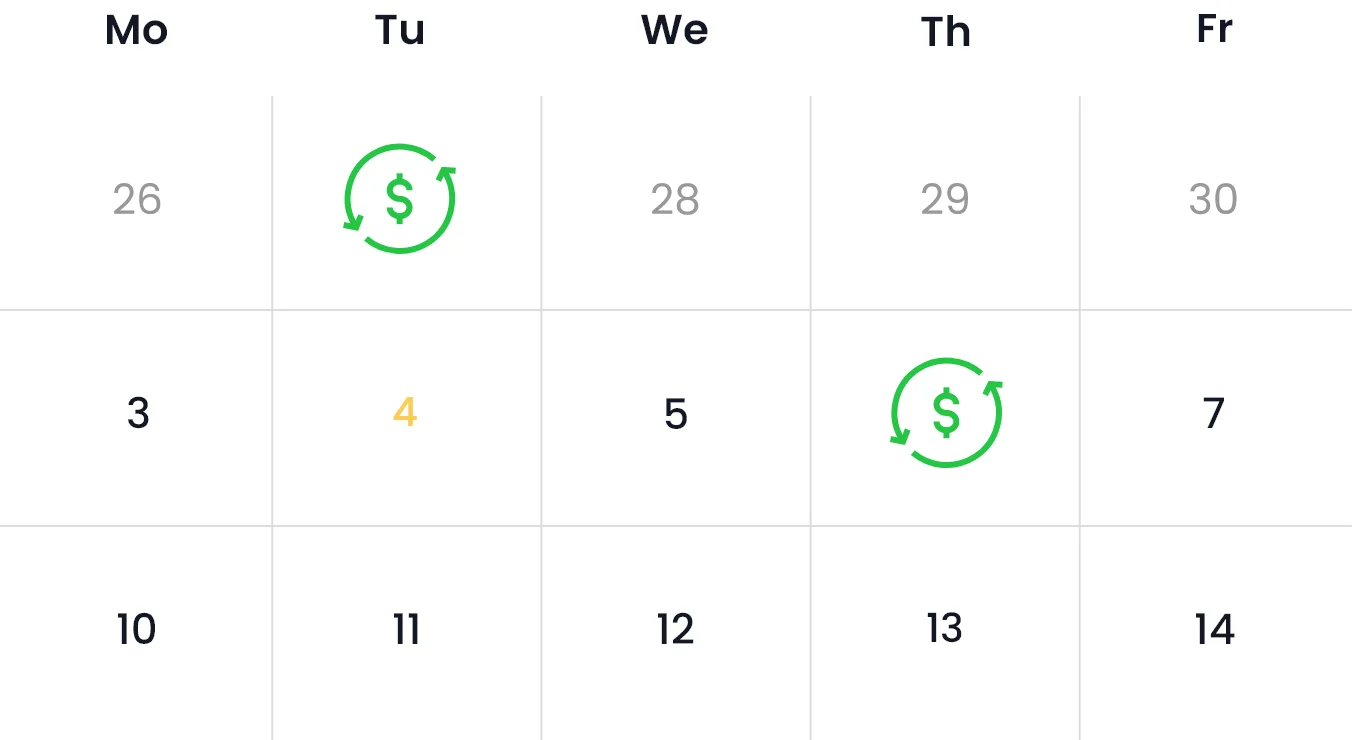

Send recurring invoices automatically

If you bill clients regularly, send them recurring invoices automatically. Choose the start date, frequency, and the number of occurrences, then let Paymo do the job for you. Your clients will receive a PDF attachment, which can be downloaded for bookkeeping purposes

Encourage client loyalty

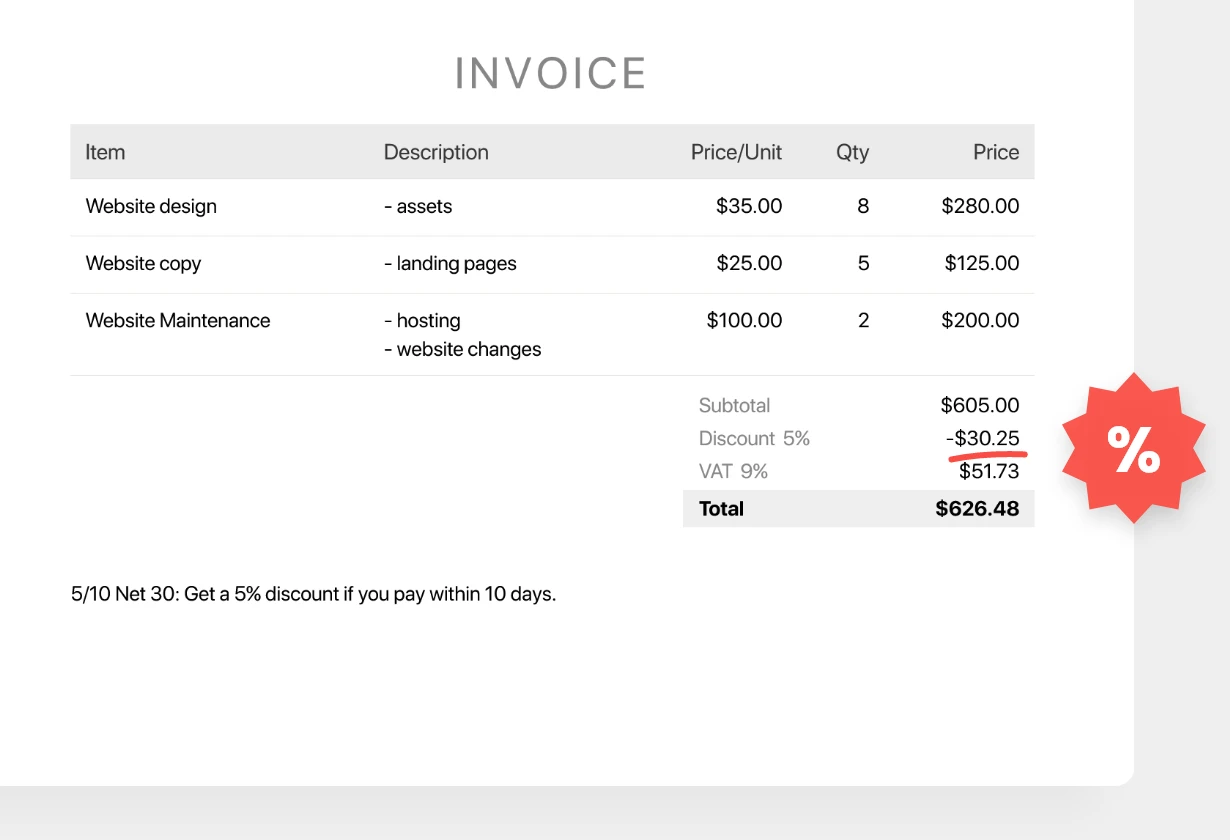

Reward your loyal clients with a global invoice percentage discount and add or subtract VAT for fiscal reporting. Set invoice payment terms for each client (e.g., Net 15) and add the date the services have been delivered to comply with local regulations.

Grow your business

Make smarter business decisions

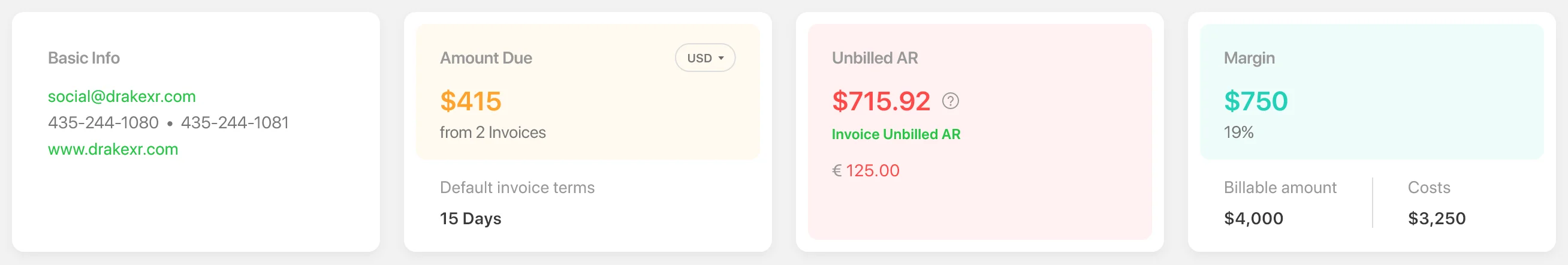

Find out whether your business is growing or your clients are falling behind their payments with the help of financial widgets. Go as far back as you need, and view all your invoicing and payment history. Track the number of invoices issued, payments received over a while, and the overall unpaid balance.

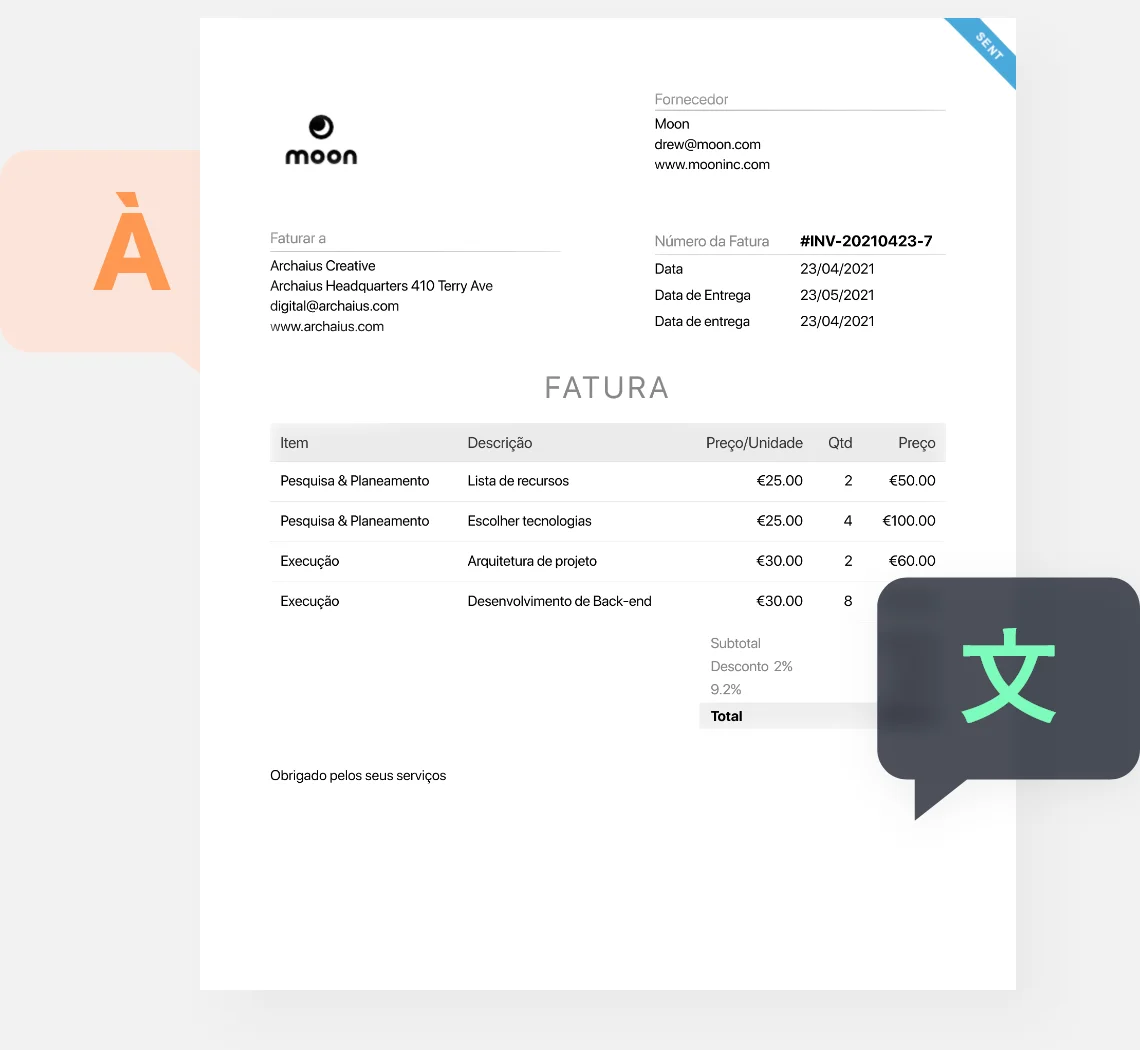

Speak your client’s language

¿Hablas español? Speaking the same language as your client brings you closer to them. Choose between 15 different language templates available for invoices and estimates, or invoice your clients in 85+ currencies within the same account.

Keep your clients in the loop

In Paymo, clients have access to their invoices and the uploaded expenses in a dedicated client portal. Your clients can filter them by status and know whether they have any pending invoices coming up.

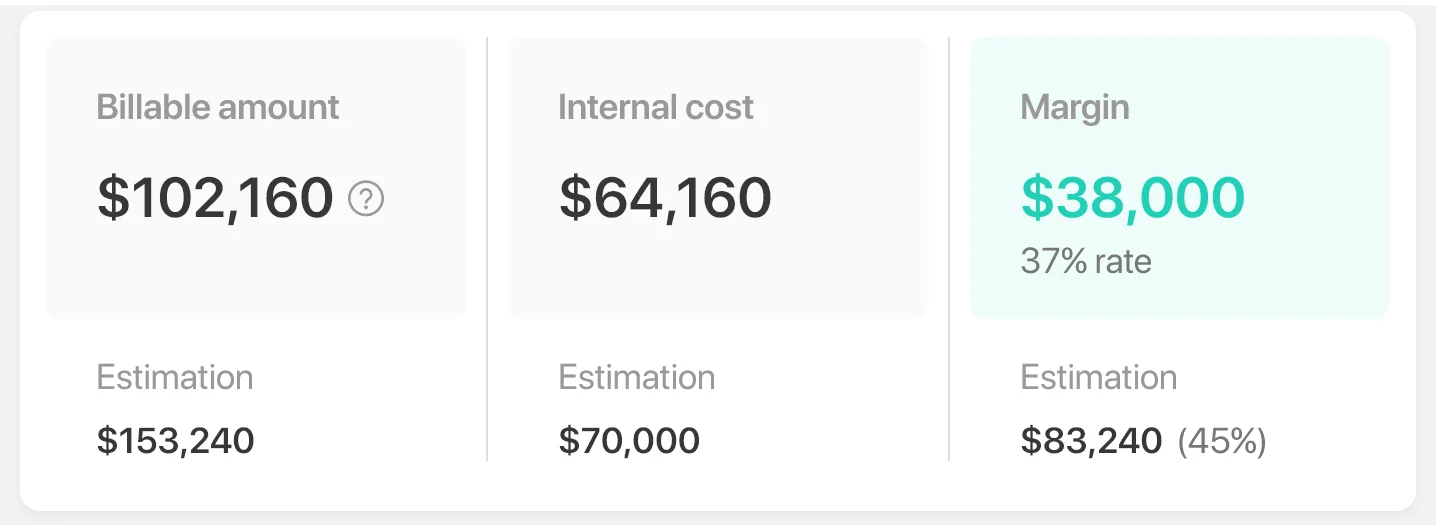

Keep track of projects’ profitability

Keep track of your project profit margins in real-time, monitor your profitability during project execution, and assess whether you’ve been profitable after project sign-off and payment.

As a small business owner, I use Paymo to help me manage my time for each of my clients and their projects. I can also easily send invoices, which allow clients to pay online, and that’s both convenient and efficient.

Marisa Peacock

Chief Strategist

@Strategic Peacock

Explore other features

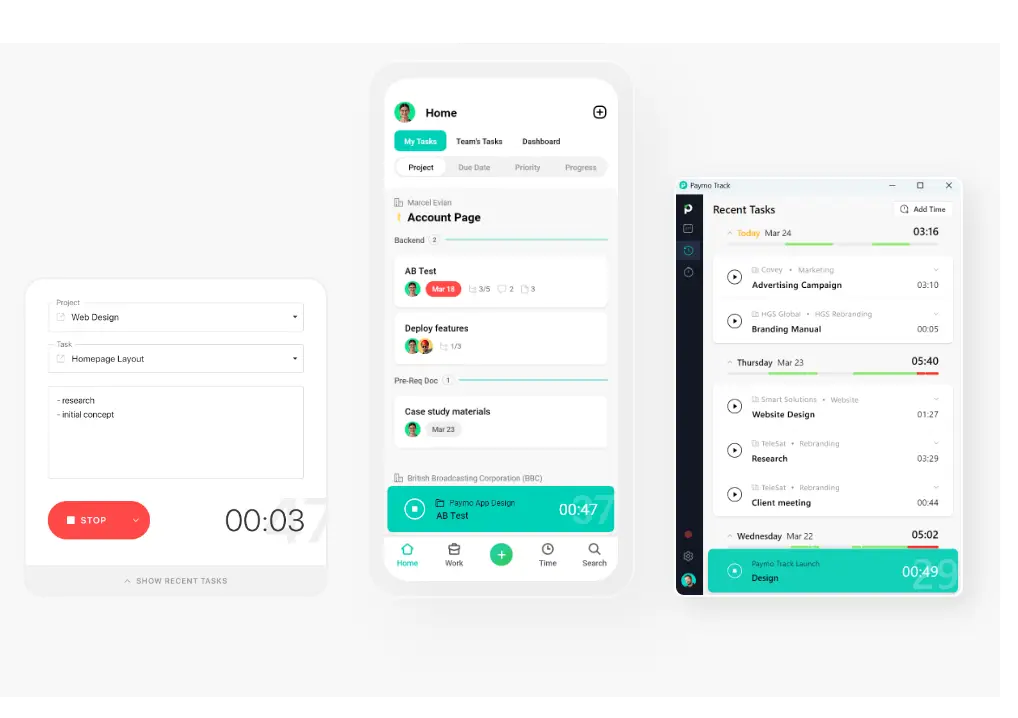

Time tracking

Log work time manually–via the web timer or the mobile tools–and automatically with Paymo Track.

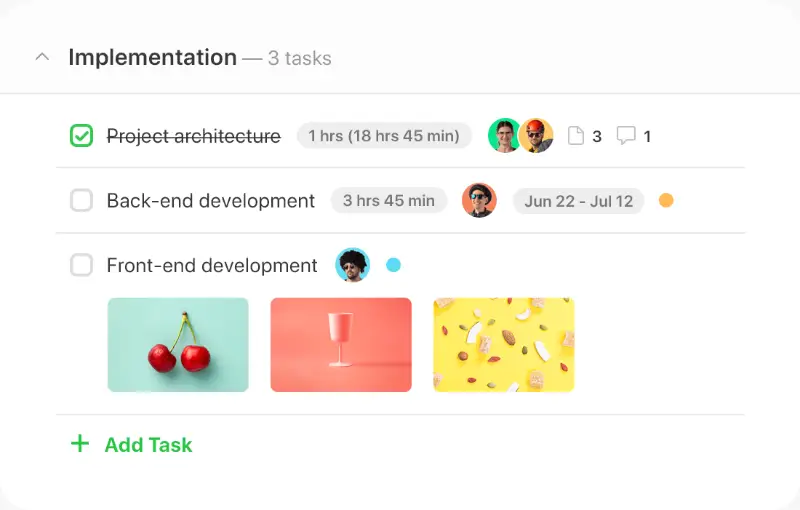

Project management

Create and assign tasks to your team members, monitor work progress, identify bottlenecks, and collaborate in real-time.

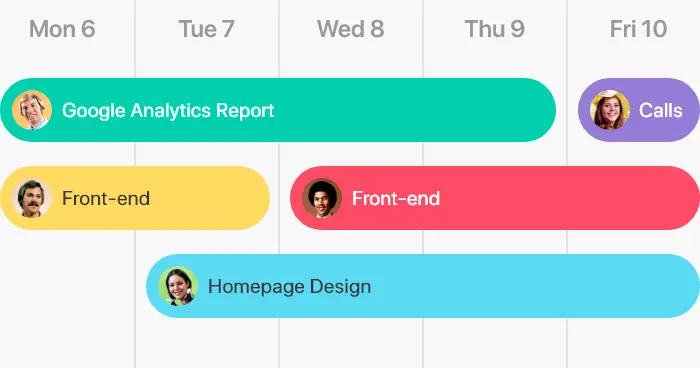

Resource management

Manage workloads, availabilities, and leave days on a visual schedule, and see at a glance who’s overbooked or underbooked.

Resources

Project Management GuidePM Software for CreativesPM Software for ArchitectsKanban SoftwareProject Management SoftwareBest Time Tracking SoftwareEmployee Time Tracking SoftwareTime Tracking Software for ConsultantsFree Invoicing SoftwareTask Management SoftwareTimesheet SoftwareResource Management SoftwareGantt Chart SoftwareTime Tracking AppsHow to Become a Project ManagerProject TrackerHow to Increase ProductivityProject Management MethodologiesCopyright © 2025 Paymo LLC

By signing up, you're agreeing with the Paymo Terms of Service and Privacy Policy

Cookies help us deliver our services. By continuing to use the website, you consent to the use of cookies.

Learn more about the cookies in Our Privacy Policy.

Desktop App

Desktop App Mobile App

Mobile App Integrations

Integrations